Cabot Announces First Quarter Operating Results

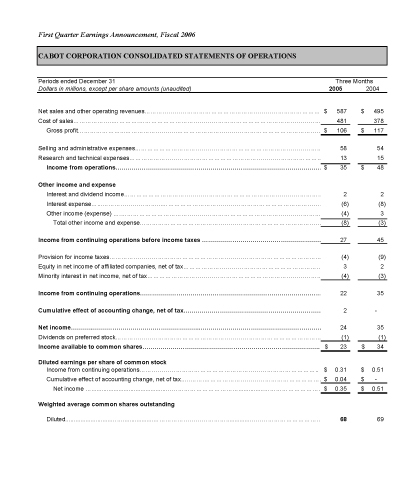

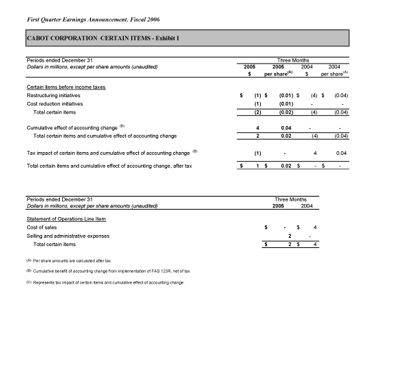

BOSTON, Feb. 1 /PRNewswire-FirstCall/ -- Cabot Corporation (NYSE: CBT) today announced net income of $24 million ($0.35 per diluted common share) for the first quarter of fiscal year 2006 ended December 31, 2005, compared with $35 million ($0.51 per diluted common share) for the year ago quarter. The first fiscal quarter 2006 results included $1 million ($0.02 per diluted common share) of after tax charges from certain items and $2 million ($0.04 per diluted common share) of after tax benefit from the cumulative effect of an accounting change, compared with $4 million ($0.04 per diluted common share) of pre-tax charges and $4 million ($0.04 per diluted common share) of tax benefit for certain items and discontinued operations for the same quarter of fiscal year 2005. Further details concerning certain items and discontinued operations are included in Exhibit I of the press release.

In commenting on the results, Kennett F. Burnes, Cabot's Chairman and CEO, said, "As expected, our results for the quarter were negatively impacted by the continued rise in raw material costs in rubber blacks and performance products and by higher ore costs in the tantalum business. We continue to actively work to optimize our cost position to lessen the impact of raw material pressures. The Supermetals Business had a strong quarter of volume growth and we remain confident in the volume strength of all of our core businesses. We were pleased during the quarter with the strong performance of both inkjet colorants and Specialty Fluids and remain encouraged with the evolution of our new businesses."

The Carbon Black Business reported operating profits of $21 million compared with $30 million in the first quarter of fiscal 2005 and a loss of $4 million in the fourth quarter of fiscal 2005. When compared to the first quarter of fiscal 2005, rubber blacks reported flat profitability and performance products reported a decrease in operating profits of $9 million. An otherwise flat quarter on a volume basis was helped by the acquisition of Showa Cabot, which increased volumes in rubber blacks by 5%. Compared to the September quarter, rubber blacks reported an increase in operating profits of $21 million and performance products reported a $5 million increase in operating profitability. Seasonal volume softness and rising feedstock costs were only partially offset by higher prices. The inkjet colorants product line had a strong quarter with volume increases of 39% year over year and 10% compared to the fourth quarter of fiscal 2005.

The Metal Oxides Business reported operating profits of $2 million compared with $6 million for the first quarter of fiscal 2005 and $1 million in the fourth quarter of fiscal 2005. When compared to the first quarter of fiscal 2005, the fumed metal oxides product line reported a $4 million decrease in profitability driven by lower volumes in traditional silicones and electronics markets, as well as higher costs due to a significant equipment failure at a supplier's hydrogen gas facility co-located at our plant in Tuscola, Illinois. "This extended disruption in hydrogen supply is affecting both our production capacity and our costs. Nonetheless, we are currently meeting all customer needs," said Burnes. Sequentially, the product line increased operating profits by $1 million.

The Supermetals Business reported $11 million in operating profits compared to $16 million in the first quarter of fiscal year 2005 and $7 million in the fourth quarter of fiscal 2005. Strong increases in market volumes and lower costs, resulting from our efforts to reposition the cost structure of this business during fiscal 2005, benefited the business sequentially. These were more than offset by the continued transition from fixed price and fixed volume contracts to market based pricing and by higher ore costs for the year compared to the first quarter of fiscal 2005. "We are encouraged by stronger demand for our tantalum products." Burnes commented. "While we remain in arbitration with the Sons of Gwalia regarding ore price, we continue to believe we will resolve this matter through a commercial settlement. As we said last quarter, the resolution of this matter will likely result in higher ore costs than last year. Our results reflect our current best estimate for ore costs for the full fiscal year. This estimate resulted in higher costs in the first quarter of fiscal 2006 due to our LIFO accounting methodology."

During the first quarter of fiscal year 2006, the Specialty Fluids Business reported operating profits of $4 million compared to $2 million in the first quarter of fiscal 2005 driven by strong rental revenues based on an increase in the volume of fluid being used. Sequentially, this business reported a decline in operating profits of $3 million due principally to a decrease in barrel rental days when compared to a particularly strong fourth quarter in fiscal 2005.

With respect to the future, Burnes said, "On balance, we are seeing an improved outlook over the remainder of the year. Demand is either solid or improving in all of our businesses and relationships with key customers remain strong. While carbon black feedstock prices appear to have stabilized, high European natural gas prices will adversely affect our profitability going forward. We are making progress in reaching a negotiated settlement with the Sons of Gwalia and we remain confident with the market development efforts in our emerging businesses as they continue to demonstrate improved profitability and the achievement of important milestones."

For those interested in more detailed information regarding Cabot's first quarter fiscal year 2006 results, please see the Supplemental Business Information available on the Company's website in the Investor Relations section: http://investor.cabot-corp.com.

Included above are forward-looking statements relating to management's expectations regarding demand for Cabot's products, future business performance and overall prospects; tantalum ore costs in the Supermetals Business; growth in inkjet colorants and the Specialty Fluids Business; and carbon black feedstock and natural gas prices. The following are some of the factors that could cause Cabot's actual results to differ materially from those expressed in the forward-looking statements: a continuing rise in feedstock costs and a higher than expected increase in natural gas prices; Cabot's ability to generate cost savings and implement restructuring initiatives; lower than expected demand for our products; the outcome of our settlement negotiations with Sons of Gwalia; the Company's ability to maintain and grow its position in the small office, home office printing market and to participate in the growth in emerging inkjet applications for black colorants and to develop and commercialize colored pigments (which may be disrupted or delayed by technical difficulties, market acceptance, competitors' new products or difficulties in moving from the experimental stage to the manufacturing stage); the success of the Specialty Fluids Business in gaining wider acceptance by the energy industry of cesium formate as a drilling fluid and to penetrate new markets (including development of the required logistics to reach remote markets); and the timely completion and start-up of capacity expansion projects. Other factors and risks are discussed in the Company's 2005 Annual Report on Form 10-K with the Securities and Exchange Commission.

Cabot Corporation is a global specialty chemicals and materials company headquartered in Boston, MA. Cabot's major products are carbon black, fumed silica, inkjet colorants, capacitor materials, and cesium formate drilling fluids.

Contact: Susannah R. Robinson

Director, Investor Relations

(617) 342-6129

SOURCE Cabot Corporation To access a copy of the Supplemental Business Information for this quarter please Click here.

02/01/2006

CONTACT: Susannah R. Robinson

Director, Investor Relations of Cabot

Corporation

+1-617-342-6129

Photo: NewsCom: http://www.newscom.com/cgi-bin/prnh/20000323/CABOTLOGO

AP Archive: http://photoarchive.ap.org

PRN Photo Desk photodesk@prnewswire.com /

Web site: http://www.cabot-corp.com

http://investor.cabot-corp.com /

(CBT)

CO: Cabot Corporation

ST: Massachusetts

IN: CHM MNG

SU: ERN

EO-MV

-- NEW035 --

9852 02/01/2006 21:53 EST http://www.prnewswire.com